Getting clarity on the co-insurance clause within your commercial insurance plan is a valuable exercise for your business! We cover the basics of what you need to know.

Getting Clear on Co-Insurance

Most commercial insurance policies have a co-insurance clause. But, it is one of the most misunderstood concepts in commercial insurance. If you are reading this and you don’t know what this clause truly means, you’re in luck! Here, we will review what co-insurance is and how it works for your business in the event of a claim.

What is Co-Insurance?

Typically, you would want to insure an item for 100% of its value, so that you are able to receive its true value from the insurance company in the case of an insurable claim. The purpose of a co-insurance clause is to encourage business owners to have the proper amount of insurance. It only penalizes you if you fail to have the proper amount of insurance in place when making a claim.

The co-insurance clause ensures that the insurance company receives a fair premium for the business risk that they are protecting, while the policyholder insures their property to the appropriate value.

If the business owner chooses to carry insurance for less than the required co-insurance value of their property (for example, 80 to 100%) and an insurable claim occurs, not only does the insurance company not have the ability to protect the full value of their property, but there are penalties to the policyholder.

A Co-Insurance Example

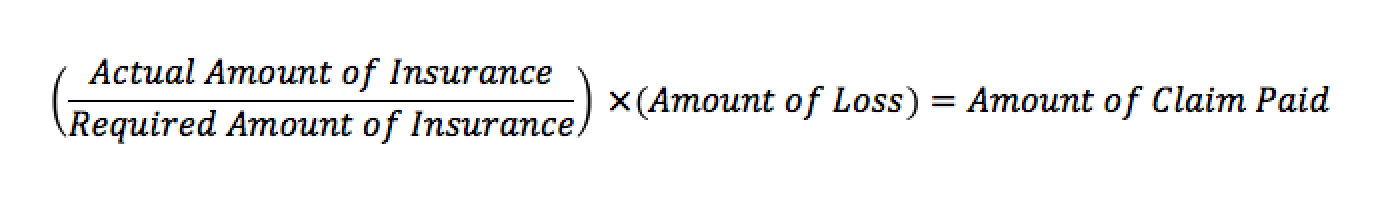

For instance, a building valued at $100,000 replacement value with a co-insurance clause of 90% must be insured for no less than $90,000. Say that this business owner carried insurance for $60,000 and then had an insurance claim for $30,000. The insurance company then follows a simple formula:

In this example, the policyholder underinsured their property, so they absorb a penalty of $10,000 – as a result of the co-insurance penalty, the policyholder only receives $20,000 for their $30,000 claim.

Replacement Cost vs Market Value

An important thing to note with insurance is that usually the replacement value of the property is used, not the market value or purchase price. It is important to have an accurate replacement cost estimation, and a professional building appraiser can give you that value. Relying on any other values other than replacement can result in some nasty surprises if you have to file a claim for that property.

Adding Value to Your Property?

Throughout your renewal year, you’re likely to add new equipment, maybe do some renovations, add new property or expand your product offering. Increasing the value of your property means that your co-insurance terms may no longer be met. It’s important that your insurance broker reviews your co-insurance clause, and increases its value in order to protect you in the event of a claim.

While every policy is different (based on your business’ needs), understanding your co-insurance clause can ensure that your business is able to recover quickly in the case of a claim. Connect with one of our commercial insurance brokers to have a full review of your business needs, or to review your current policy!